Refinance Home Loan Fundamentals Explained

Table of ContentsThe Clark Finance Group Refinance Home Loan DiariesNot known Incorrect Statements About Clark Finance Group Mill Park Some Known Details About Refinance Home Loan Some Of Clark Finance Group Home Loan Lender

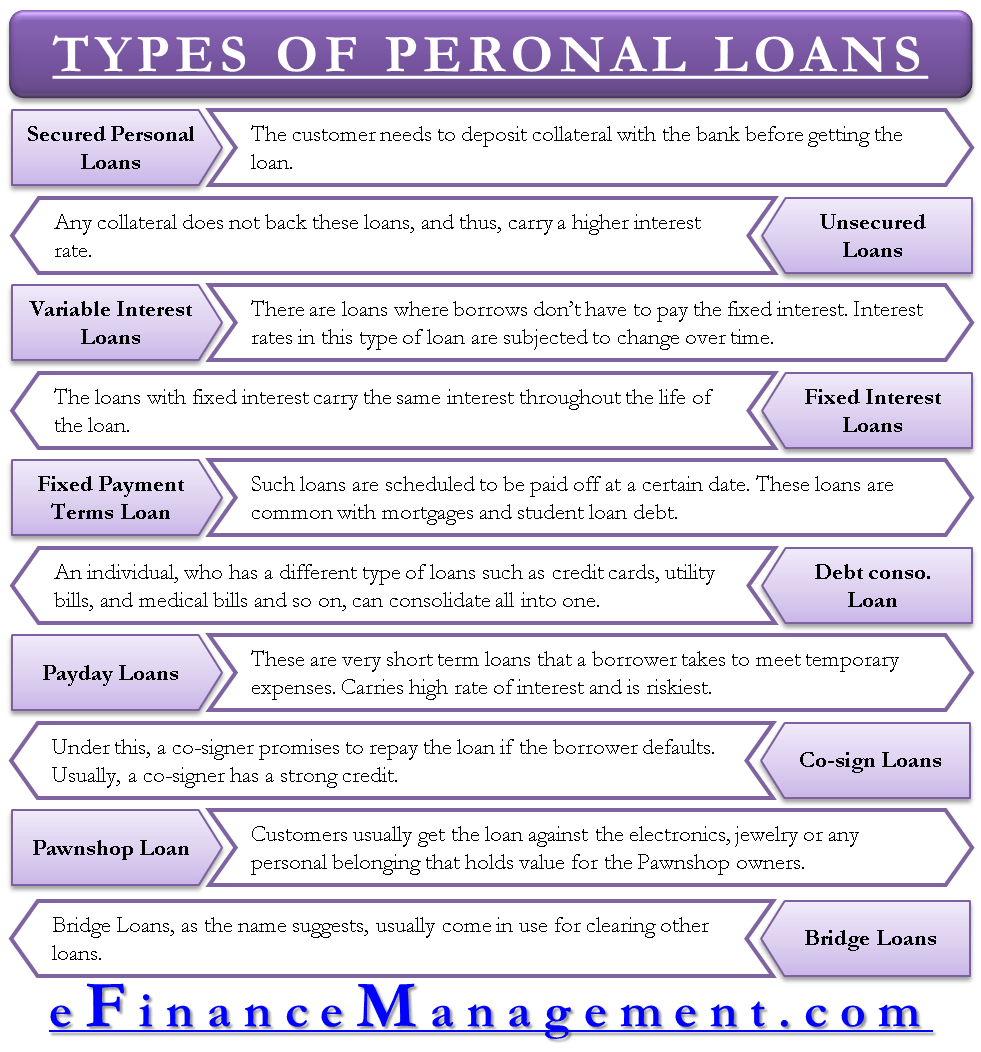

That's why we provide features like your Approval Chances and also cost savings quotes. Obviously, the deals on our system don't stand for all monetary products out there, but our goal is to show you as numerous wonderful choices as we can. All fundings aren't created equal. If you need to obtain cash, initially, you'll intend to determine which kind of finance is right for your scenario.

If you have high-interest credit card debt, a personal financing may aid you repay that financial debt sooner. To settle your financial debt with an individual financing, you 'd apply for a financing in the quantity you owe on your charge card. Then, if you're approved for the sum total, you 'd make use of the lending funds to pay your debt cards off, rather making month-to-month settlements on your individual financing.

That's because the lender might take into consideration a protected lending to be less risky there's a property supporting your car loan. If you don't mind pledging security and you're certain you can repay your loan, a secured funding might help you conserve money on interest. When you utilize your collateral to take out a car loan, you run the risk of shedding the home you offered as security.

Get This Report on Clark Finance Group Mill Park

A pawn shop lending is another fast-cash borrowing alternative. You'll take an item of worth, like an item of jewelry or a digital, into a pawn shop and borrow cash based on the item's worth. Car loan terms vary based on the pawn shop, as well as rate of interest can be high. Some states have actually tipped in to regulate the sector.

You may also obtain struck with fees as well as added expenses for storage, insurance or restoring your car loan term. A cash advance option financing is a short-term funding supplied by some government credit score unions. A PAL is created to be much more budget-friendly than a cash advance. Payday different view it car loan quantities vary from $200 to $1,000, and they have longer payment terms than payday advance loans one to 6 months instead of the common few weeks you get with a payday advance (Mortgage broker).

A home equity financing is a type of secured loan where your house is used as collateral to borrow a round figure of cash. The amount you can obtain is based on the equity you have in your home, or the difference in between your home's market worth as well as just how much you owe on your house.

Considering that you're using your home as collateral, your passion price with a residence equity financing may be lower than with an unsafe individual funding. You can use your house equity car loan for a selection of purposes, varying from residence renovations to medical expenses. Prior to securing a house equity funding, see to it the payments remain in your budget.

Clark Finance Group - Truths

She delights in helping individuals find means to better manage their cash. Her work can be discovered on countless sites, consisting of i was reading this Bankrate, Financing, Bu Read more. Review Extra.

Below are the most common types of lendings and also exactly how they work. Secret Takeaways Personal lendings as well as debt cards come with high rate of interest rates however do not call for collateral.

Money advances normally have very high rate of interest prices plus purchase charges., which implies that the customer does not place up collateral that can be confiscated in situation of default, as with a vehicle funding or residence mortgage.

Clark Finance Group Can Be Fun For Anyone

However interest prices can be more than three times that quantity: Avant's APRs range from 9. 95% to 35. 99%. The very best rates can just be acquired by individuals with remarkable credit rankings and significant possessions. The most awful have to be withstood by people who have nothing else choice. A personal funding is probably the very best means to opt for those who require to borrow a reasonably tiny quantity of money as well as are particular they can settle it within a pair of years.

Financial institution Lending vs. Bank Assurance A financial institution funding is not the like a bank guarantee. A bank might provide an assurance as surety to a 3rd party in behalf of among its customers. If the consumer falls short to fulfill the pertinent legal responsibility with the 3rd party, that party can require repayment from the financial institution.

A company might approve a professional's quote, as an example, on the condition that the specialist's financial institution issues a warranty navigate here of settlement in case the professional defaults on the contract. A personal funding may be best for somebody who requires to borrow a fairly little amount of money and also is certain of their capacity to settle it within a number of years.